do you have to pay inheritance tax in arkansas

Surviving spouses for example do not pay inheritance tax. Arkansas also does not have a gift tax.

What States Do Not Have Property Tax Quora

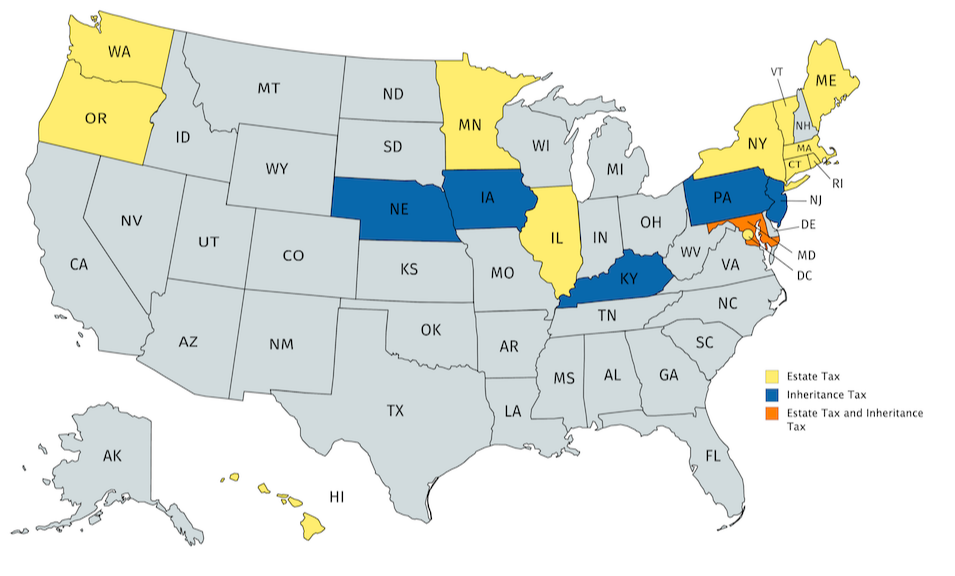

Although Arkansas does not require you to pay an inheritance or estate tax youre not exempt from paying them entirely.

. Thats because federal law doesnt charge any. So the overall amount of inheritance tax that Person As son needed to pay was 66000 275000 x 24 66000. The tax rate varies.

Inheritance taxes can apply regardless of whether the deceased person had a Louisiana Last. It allows the states residents simply gift away the taxable parts of their estates and protect their inheritance. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state.

An inheritance tax is a tax imposed on someone who inherits money from a deceased person. The first rule is simple. Because the gift used up Person As entire nil-rate band their son.

The annual exemption limit for 2022 is 16000 This means that there is no tax on gifts that do not exceed this amount. Arkansas does not have an inheritance tax. If you inherit property you dont have to pay a capital gains tax until you sell the plot.

The Balance Catherine Song. If youre the beneficiary of a trust you must be wondering whether you need to pay taxes on a trust inheritance or not. Do you have to pay taxes on inheritance money.

Children and other beneficiaries face different tax laws depending on the state. Any exemptions allowed by the. You could potentially be liable for three types of taxes if youve received a bequest from a friend or relative who has died.

Do you have to pay taxes on. The laws regarding inheritance tax do. In 2021 the current federal estate exemption is 117.

I inherited from my brother in law who passed a - Answered by a verified Tax Professional. While there is no federal inheritance tax and no Arkansas inheritance tax there may be certain instances in which a beneficiary will have to pay income tax on part of their. Inheritances that fall below these exemption amounts arent subject to the tax.

There is no federal inheritance tax. If you receive property in an inheritance you wont owe any federal tax. The inheritance laws of another.

You might inherit 100000 but you would pay an inheritance tax on just 50000 if the state only imposes the tax on inheritances over 50000. This gift-tax limit does not refer to the total amount you. This does not mean however that Arkansas residents will never have to pay an inheritance tax.

According to the 2021 House Price Index the average property value in the UK is 256405. An inheritance tax a. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

You have met with the trustee and the other beneficiaries.

Advocating For Agriculture Arkansas Farm Bureau

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Is There An Inheritance Tax In Arkansas

Arkansas Inheritance Laws What You Should Know Smartasset

Paycheck And Politics Newsletter Issue 28 Arkansas Advocates For Children And Families Aacf

Free Arkansas Bill Of Sale Forms 5 Pdf Eforms

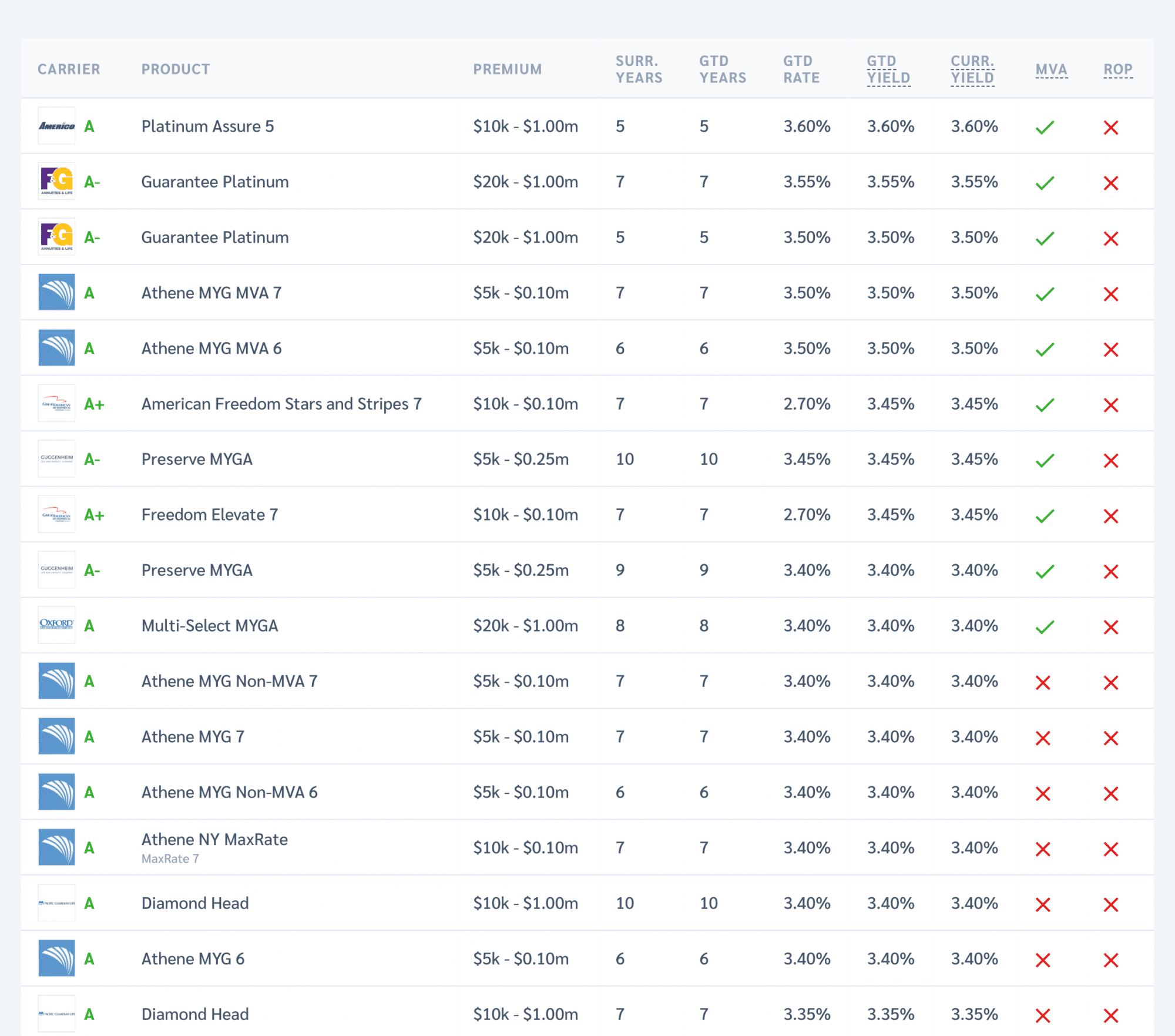

State Estate And Inheritance Tax Treatment Of 529 Plans

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Death Tax Hikes Loom Where Not To Die In 2021

F0533934 E69e 42a3 B9ca 980c797d3491 1920x1080 Jpg

What Is Inheritance Tax Probate Advance

State Taxes On Capital Gains Center On Budget And Policy Priorities

:focal(959x654:961x656)/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

Arkansas State Tax Guide Kiplinger

Inheritance Tax Checklist Know Before You Sell Sensible Money

15 States That Don T Tax Retirement Income Pensions Social Security

Estate Planning Services Arkansas Estate Tax Planner Arizona

Inheritance Tax What It Is And What You Need To Know

A New Study Assesses Whether Inheritance Taxes Boost Net Revenues The Economist